What is Accounting?

Accounting is the process whereby transactions are recorded and classified on a monetary basis. It is how we communicate where money is coming from, going to, and the individual or organization’s overall financial position.

Managerial Accounting: information provided to internal users (i.e. managers, executives).

Financial Accounting: information provided to external users (i.e. investors, creditors).

Debits & Credits

Debits and credits are the terms used to delegate aspects of transactions to their respective accounts such that the transactions balance. In accounting, debit means left and is abbreviated as DR, while credit means right and is abbreviated as CR. When a transaction takes place a journal entry is written where the debits precede the credits, and the credits are indented. Within the journal entry total debits MUST equal total credits, such that the transaction balances. If you want this written as an equation, Total Debits = Total Credits.

Journal entries will be covered in greater depth later.

Basic Accounts

There are five overall types of accounts: Asset accounts, Liability accounts, and Owner’s (Stockholder’s) Equity accounts make up what is known as The Accounting Equation: Assets = Liabilities + Owner’s Equity, in other words, total assets MUST equal total liabilities plus total equity. Assets are the resources available for use, while Liabilities and Owner’s Equity are the claims to those resources. The remaining two accounts are Revenues and Expenses.

- Assets: resources for future benefits.

- Common Accounts: Cash, Accounts Receivable (A/R), Land, Equipment, Inventory, etc.

- Liabilities: portion of resources attributable to creditors.

- Common Accounts: Accounts Payable (A/P), Notes Payable (N/P), etc.

- Owner’s (Stockholder’s) Equity: portion of resources attributable to the owner/s.

- Common Accounts: Common Stock (C/S), Retained Earnings (RE), Dividends, etc.

- Revenues: earnings from operations.

- Common Accounts: Sales Revenue, Service Revenue, etc.

- Expenses: cost of operations. Assets that are used or consumed become an expense.

- Common Accounts: Wages Expense, Interest Expense, Depreciation expense, etc.

Every account either increases with a debit, making it a Debit Account, or increases with a credit, making it a Credit Account. A couple useful acronyms to remember the Debit and Credit Accounts is DEAD (for Debit Expenses, Assets, and Dividends), or my preferred, DEALOR(Debit: Dividends, Expenses, and Assets; Credit: Liabilities, Owner’s (Stockholder’s Equity), and Revenues). If you struggle to remember that debit means left and credit means right, use the DEAD acronym as a reminder of which accounts are specifically debit accounts, but if you can remember your left from right just split DEALOR down the middle and the left-hand side are your debit accounts while the right-hand side are your credit accounts.

What is a General Ledger?

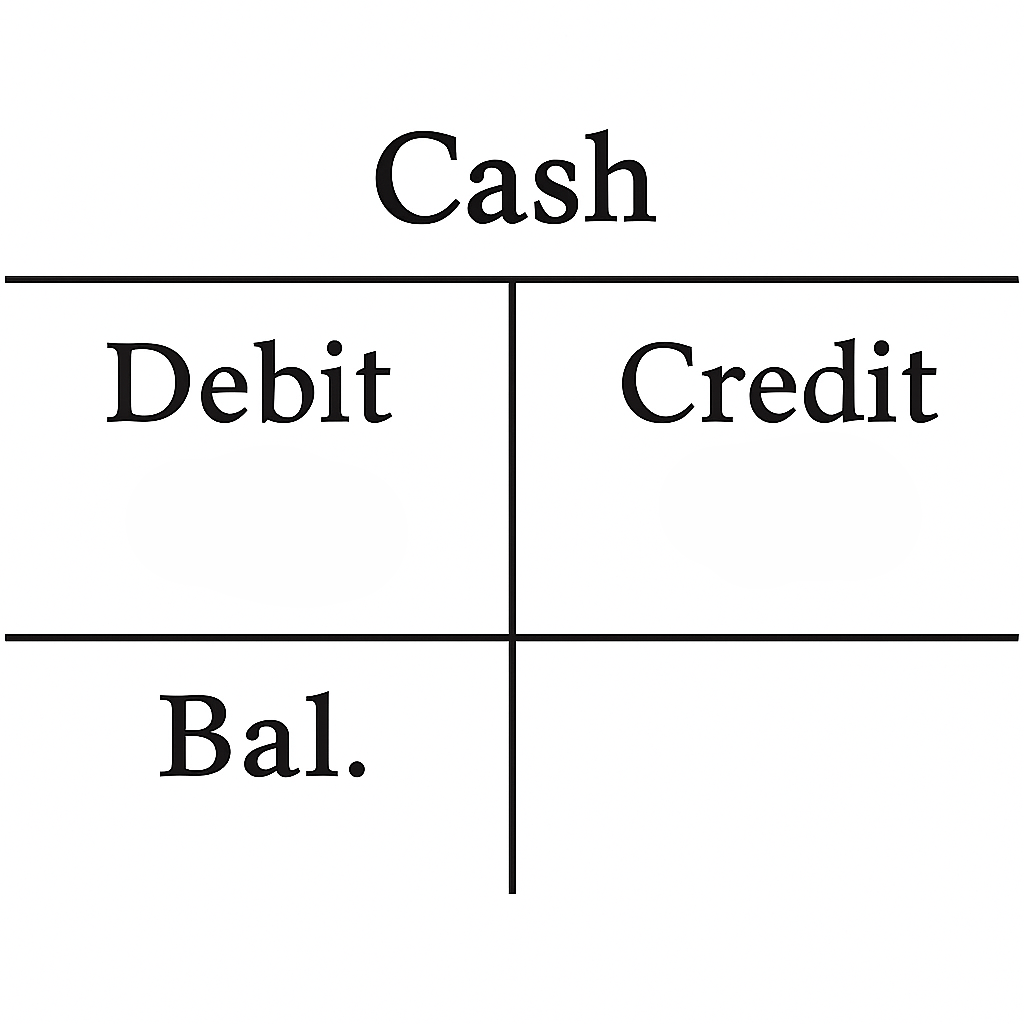

A General Ledger is a list of accounts and the subsequent debit and credit amounts as a result of transactions. While most companies use automated ledgers now, it will be useful to know how to build one yourself. Most manually operated General Ledgers make use of ‘T-Accounts’ in which the account name is suspended over the horizontal of the ‘T’ and the debits and credits are applied to the left and right of the vertical, see example below.

The account in question is the ‘Cash’ account, with debits and credits on the left and right respectively; this is the case with every T-account whether they are a Debit or Credit Account. Notice however that the balance is on the left in this example, that is because Cash is an Asset and therefore a Debit Account, and in most cases debit accounts will have debits in excess of credits and as such will have a debit balance; the same is generally true of credit accounts.

A General Ledger contains all the debit and credit entries from every transaction on record within their respective accounts. So how do we record a transaction?

What is a Journal Entry?

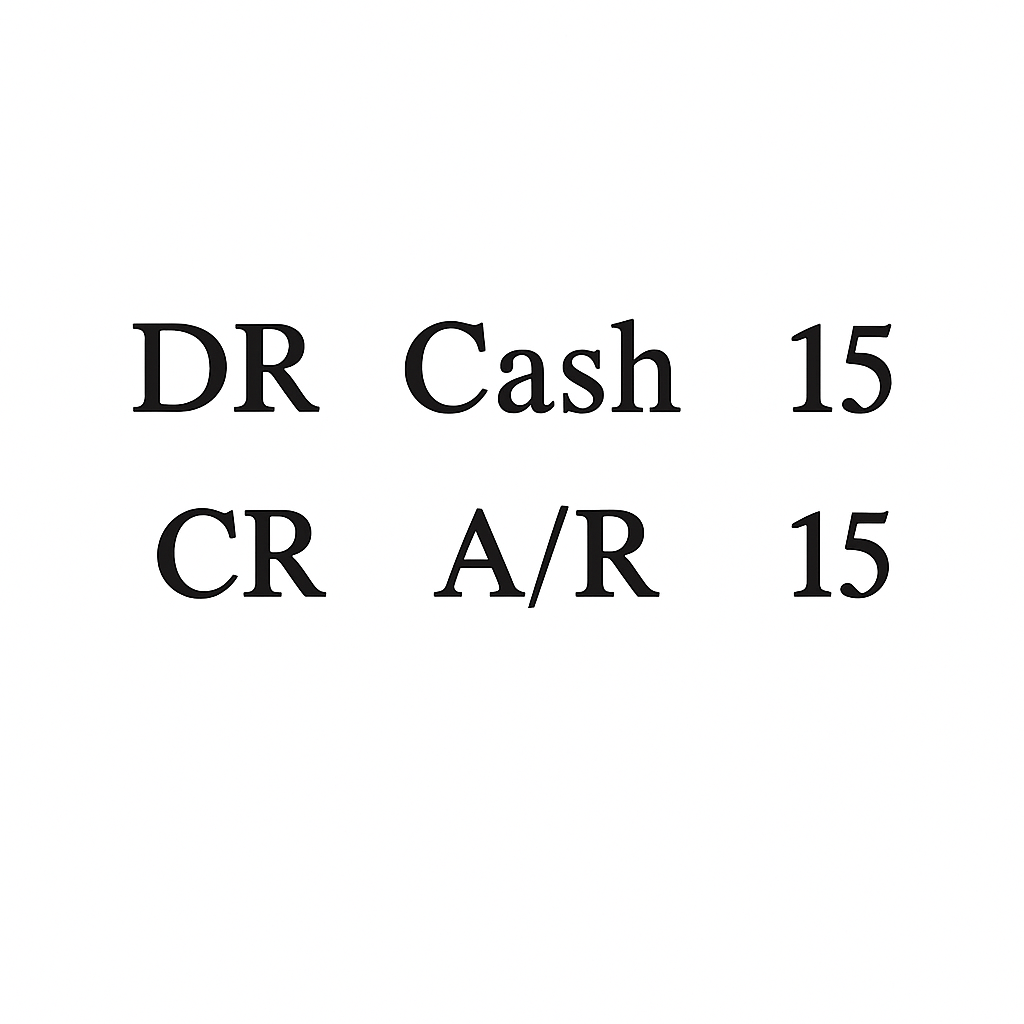

A Journal Entry (JE) is the process by which a transaction is manually recorded, every entry will have at least one debit and at least on credit. The purpose of a journal entry is to record a transaction and the effect that transaction has on relevant accounts, for example: let’s say someone owes you 15 dollars, that 15 dollars is represented as a debit to the Accounts Receivable (A/R) account because A/R is an asset, and therefore a debit account. When you are paid that 15 dollars you are owed, Accounts Receivable is credited for 15 dollars in order to remove it from the amount you are owed, and the Cash account is debited for 15 dollars showing the increase in cash on hand. Notice that total debits (15) equals total credits (15), this must always be the case, and is especially important to keep track of when more accounts are involved in a given transaction.

(Imagine the CR line is indented by the width of the “DR” for a more accurate representation of a Journal Entry…)

What Are Contra Accounts?

Contra accounts are accounts that “adjust” the value of another account indirectly. They function opposite the way the opposing account functions, for example a contra account to a normal debit account will function as a normal credit account.

Contra-Asset Accounts:

- Accumulated Depreciation (A/D): Accumulated Depreciation is a contra-asset account that indirectly reduces the value of any depreciable asset. Depreciable Assets are assets that incur depreciation expense, thereby reducing its current value, but instead of directly reducing the value of the asset by directly adjusting the account, a new account is created that acts to reduce the value in the asset account. A/D accumulates via the expense account Depreciation Expense.

- Common Depreciable Assets: Equipment, Buildings, Land Improvements, etc.

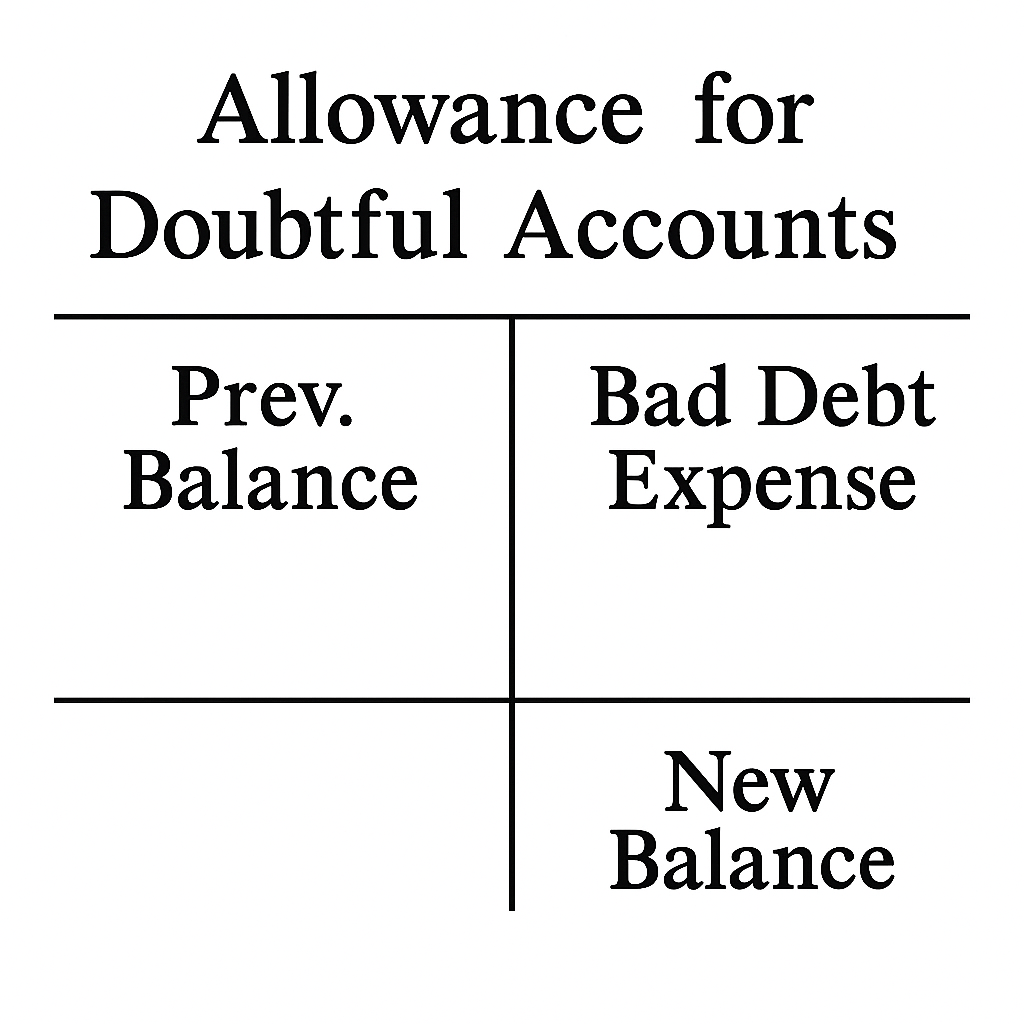

- Allowance for Doubtful Accounts: the contra-asset account to Accounts Receivable (A/R). Allowance for Doubtful Accounts (shortened as Allow. from now on) is the amount of compensation owed to you/the organization that is expected not to be received. Total Allow. is determined first, generally as a proportion of total outstanding A/R, and Bad Debt Expense is recognized to bring the current value of the Allow. account to its determined value. As amounts are determined to be uncollectible the Allow. account is debited (remember, Allow. is a contra-asset account making it a normal credit account) for the amount deemed uncollectible, reducing the amount in the account. Unlike most accounts, since the total amount deemed uncollectible was an estimate, and actual is likely to be different that estimated, the Allow. account, while a normal credit account, can have a debit balance at the end of the period if actual amounts uncollectible exceed the estimated amount for the period.

Although Previous Balance is shown on the debit side in this example that will not always be the case, it all depends on actual uncollectible amounts, if the amount uncollectible is lower than estimated then the previous balance will be on the credit side and Bad Debt Expense will not be as high.

You must be logged in to post a comment.